HDPE Membrane Manufacturer focuses on producing impermeable sheets that block water, chemicals, and gas. High-density polyethylene (HDPE) sheets dominate the market because they weld fast, resist acids, and last decades under the desert sun. Engineers in Saudi Arabia now pick HDPE over concrete for new landfills, shrimp farms, and oil-field pits. This shift pushes local demand up 12 % every year. Global players answer the call, but five suppliers lead the race today.

1. SOLMAX—Global HDPE Membrane Manufacturer that now ships to Jeddah every week

1.1 Advantages of SOLMAX in the HDPE membrane manufacturer sector

1.1.1 High-Quality & Innovative Products

SOLMAX runs a seven-layer extrusion line in Canada and turns out 2.5 mm smooth sheet that passes Saudi Aramco’s toughest leachate test. The company adds UV boosters so the sheet survives 50 °C summer heat.

1.1.2 Market Leadership & Gulf Presence

SOLMAX opened a 6 000 m² warehouse in King Abdullah Economic City in 2023. Stock moves to Dammam or Riyadh in 48 hours, cutting site downtime for Saudi EPC firms.

1.2 Disadvantages of SOLMAX in the HDPE membrane manufacturer sector

1.2.1 Higher Cost Compared to Regional Plants

A 1.5 mm SOLMAX sheet lands in Saudi at USD 2.90 /m², 25 % above Chinese offers. Budget-driven owners often split orders to save cash.

1.2.2 Long Haul from Main Plants

If stock runs out, fresh rolls sail from Montreal for 28 days. Rush air freight doubles the price and erodes the original budget.

1.2.3 Raw-Material Price Swing

Polyethylene resin quotes jump with oil futures. SOLMAX revises its Gulf price list every quarter, complicating mid-project cost control for Saudi clients.

2. BPM Geosynthetics—Chinese HDPE Membrane Manufacturer that wins Saudi tenders with sharp prices

2.1 Advantages of BPM in the HDPE membrane manufacturer field

2.1.1 Factory Scale

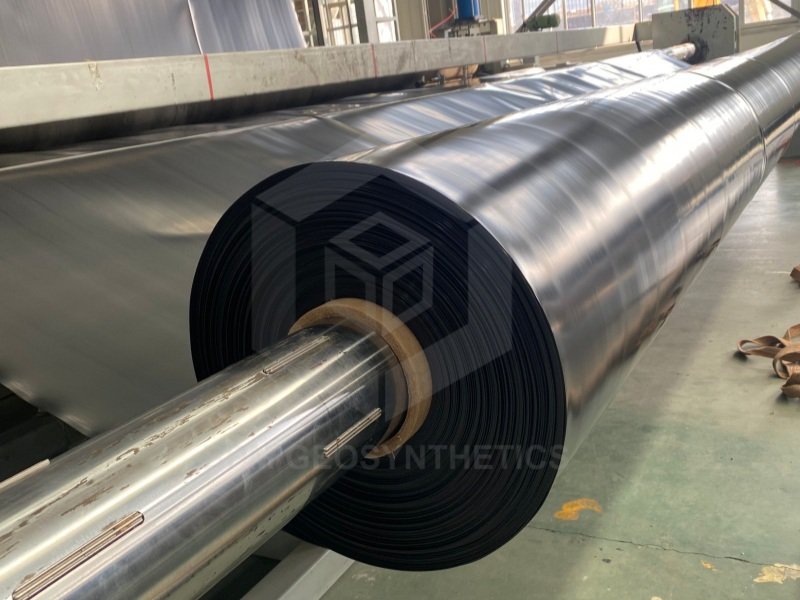

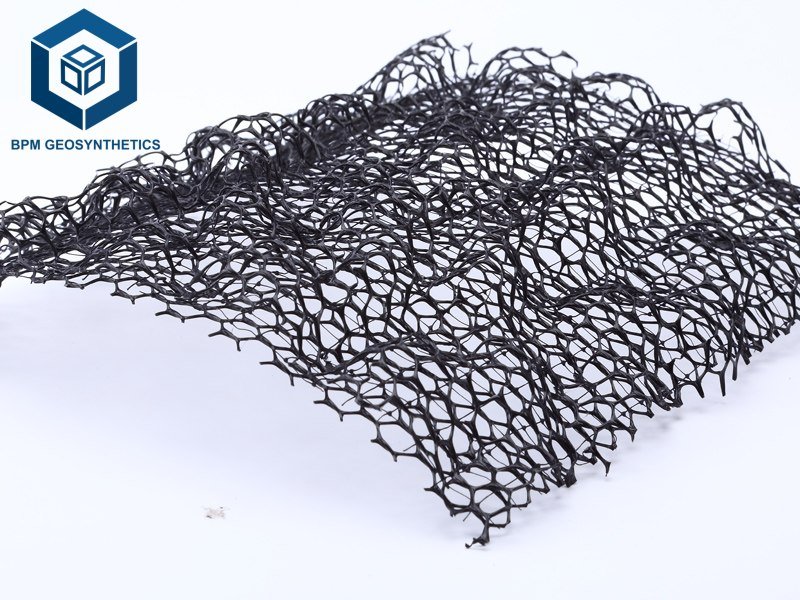

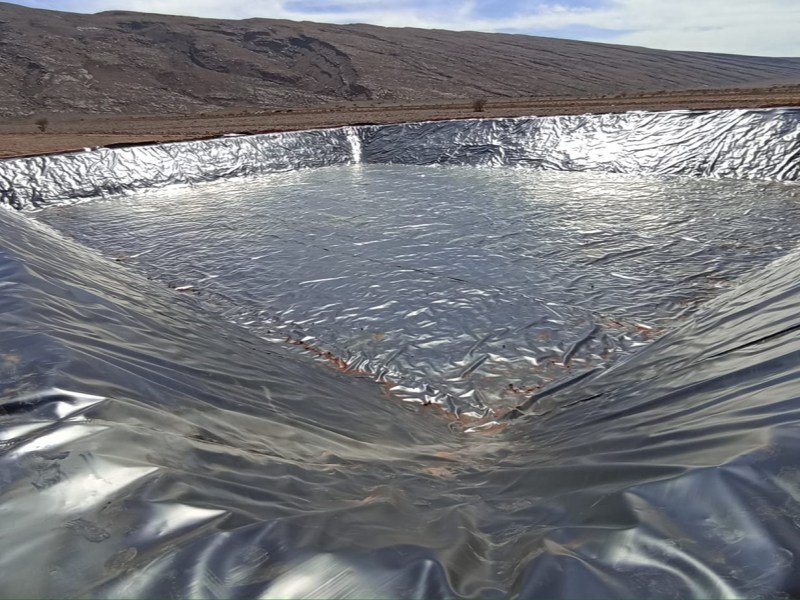

BPM Geosynthetics owns five blown-film lines in Shandong Province, China. The firm ships 40 containers a month to King Abdulaziz Port. Daily output hits 60 t, so a 300000 m² shrimp-farm order finishes in ten days.

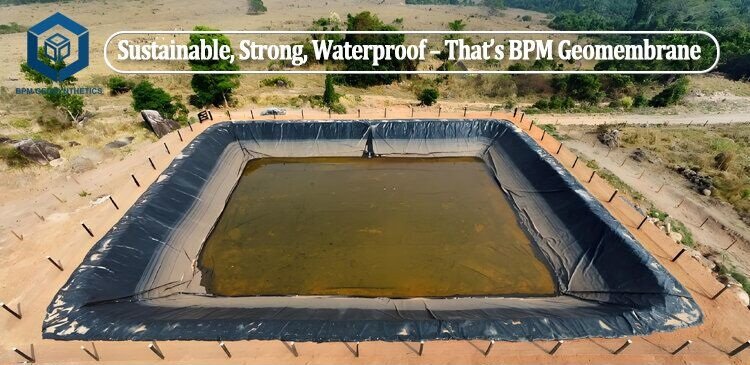

2.1.2 Flexible Customization

BPM cuts rolls to 7-9 m width so Saudi installers cover a 30 m pond in four passes, not six. And other colors and size can be customized. The firm offers a ten-year UV warranty, rare among Chinese makers.

2.1.3 Small-Batch Friendly

A Riyadh poultry farm can order 2000 m² of 0.75 mm sheet and still get BPM’s export packing. Local traders rarely accept such low volumes.

2.1.4 Qualifications and R&D

The company has passed ISO 9001 quality management system and ISO 14001 environmental system certifications, and has been recognized as a “High-tech Enterprise”. It has jointly established laboratories with universities such as Shandong University of Science and Technology and holds 6 utility model patents. It can independently complete a full set of tests including ASTM D6392 and GB/T 17643.

2.2 Shortcomings of BPM in the HDPE membrane manufacturer field

2.2.1 Weak Brand in the Gulf

Saudi consultants still ask for “GM13 certificate signed in USA.” BPM holds the lab test, yet the stamp is Chinese, so some bids lose on paperwork. As an improvement measure, if BPM needs to win more bidding projects, they need to obtain test reports from US laboratories.

2.2.2 Thin Local Service Net

BPM keeps no welding crew in Saudi Arabia. Site teams fly in from Kuwait or Bahrain, adding USD 0.25 /m² in travel cost.

3. Taian Jingwei New Material

3.1 Jingwei joined the International Geosynthetics Society in 2010 and now targets Ma’aden gold sites. —Shandong-based HDPE Membrane Manufacturer that sells HDPE smooth liner to Saudi mining

Product Line introduction:

Jingwei Geotechnical has three blown film production lines and two flat extrusion lines, capable of producing over twenty materials including 0.5mm-3.0 mm smooth/textured HDPE membranes, composite geomembranes, aquaculture geomembranes, biaxially oriented geogrids, fiberglass geogrids, and bentonite waterproofing blankets, with a maximum width of 8 m and a daily production capacity of approximately 80 tons.

Market Coverage

Products are exported to over 80 countries, with agency warehouses in Saudi Arabia, Chile, and Malaysia. Domestically, it is a first-tier supplier to China Railway, China Water Resources, and China State Construction Engineering Corporation, participating in key projects such as the South-to-North Water Diversion Project, the Beijing-Shanghai High-Speed Railway, and the Xiong’an New Area landfill.

3.2 Weaknesses

3.2.1 Insufficient Certification Coverage

Although the company has passed ISO certification, GRI-GM13, NSF/ANSI 61, and BAM certifications are still in the application stage. Some government projects in the Middle East mandate NSF certification, forcing Jingwei to supply through subcontracting, resulting in a 5%-8% reduction in profits due to general contracting.

3.2.2 Limited Overseas Inventory

Aside from a 1,000-roll inventory warehouse in Jeddah, Saudi Arabia, other regions rely on FOB Qingdao delivery. If customers urgently need replenishment, air freight costs reach USD 1.2/kg, significantly higher than Geosintex or Solmax, which have local factories.

3.2.3 Lagging Low-Carbon Image

The 2024 ESG report shows that Jingwei’s recycled material ratio is only 8%, lower than the 30% level of its European and American counterparts. European customers are beginning to impose carbon tariffs, potentially leading to additional costs of USD 55-75 per ton in the future, which could weaken its price advantage.

4. Agru America

4.1 Company Footprint—U.S. HDPE Membrane Manufacturer that delivers ultra-thick sheet for Saudi hazardous ponds

Agru America extrudes in Georgetown, South Carolina, but its parent plant in Austria holds the formula that passes ASTM D5397 stress-crack tests. Rolls ride on MSC vessels to Jeddah in 22 days.

4.2 Core Edge

4.2.1 Multi-Layer Co-Extrusion

Agru bonds five layers in one shot. The outer skins weld at 420 °C while the core holds 3 000 h ESCR. Saudi waste-to-energy plants like the combo: fast welding plus long life.

4.2.2 Ultra-Thick Gauge

Agru ships 2.5 mm and 3.0 mm sheet straight to Ras Al-Khair. Local reps train Saudi welders on dual-hot-wedge machines, cutting install time 15 %.

4.3 Surface Grip

Agru’s Sure-Grip texture hits 0.65 friction angle, keeping 1:2 slope liners stable during 70 °C afternoon dust storms.

5. Geosintex

5.1 Plant Location—Local HDPE Membrane Manufacturer that cuts lead time to seven days

Geosintex opened a 12000 m² hall in the industrial zone of Jeddah in 2019. German-built die heads turn out 8 m wide rolls 24 /7.

5.2 Flagship Sheet

5.2.1 HDPE Rough Sheet

The company uses Sabic-grade PE-100 resin, resisting pH 2–12. Textured surfaces exceed 0.60 friction, beating most Gulf imports. Thickness spans 0.75 mm–3.0 mm.

5.3 Market Focus

Geosintex serves the Red Sea Project tourism ponds, Sabic chemical bunds, and NEOM aquaculture tanks. Local rules require 48 h site response—Geosintex sends a weld tech the same day.

5.4 Stock Edge

A 500000 m² inventory sits ten km from the port. Contractors skip the 30-day ocean wait and meet tight royal-commission deadlines.

Conclusion

These five high-density polyethylene (HDPE) membrane manufacturers are vying for the Saudi market, each leveraging their respective strengths. SOLMAX offers high-quality resin and local warehousing, but its prices deter cost-conscious owners. BPM Geosynthetics floods the market with cost-effective products and custom widths, but still faces brand bias. Agru America sells ultra-thick membranes for oilfield brine pools and trains construction workers for rapid welding. Geosintex has the advantage of local access: raw materials from Saudi Basic Industries Corporation (SABIC), same-day on-site support, and no customs delays. Together, they are driving Saudi infrastructure towards tighter enclosure, longer lifespan, and more precise total cost control.