Pond liners are essential impermeable barriers crafted from synthetic materials to prevent water seepage, ensuring efficient containment in a variety of applications from decorative garden features to large-scale agricultural reservoirs. Primarily composed of high-density polyethylene (HDPE), ethylene propylene diene monomer (EPDM), reinforced polyethylene (RPE), polyvinyl chloride (PVC), and butyl rubber, these liners provide superior durability, chemical resistance, and UV stability, with typical specifications including thicknesses of 0.5 to 3.0 millimeters (20 to 120 mil), tensile strengths of 20 to 40 kN/m (ASTM D6693), and puncture resistances exceeding 300 to 1,000 N (ASTM D4833). In a world grappling with water scarcity and environmental imperatives, pond liners play a vital role in conserving resources, supporting aquaculture productivity, and mitigating contamination risks, achieving up to 99.9% water retention efficiency and extending pond lifespans by 20–40 years compared to unlined alternatives, as per industry benchmarks from the Geosynthetic Institute.

The global pond liner market, valued at USD 1.75 billion in 2024, is poised for steady expansion, projected to reach USD 3.67 billion by 2034 at a compound annual growth rate (CAGR) of 7.70%, according to Expert Market Research. This growth trajectory is underpinned by surging demand in aquaculture (42% market share), agricultural irrigation (30%), stormwater management (15%), and decorative landscaping (13%), fueled by regulatory frameworks such as the U.S. EPA’s Clean Water Act and the European Union’s Water Framework Directive, which enforce stringent containment standards to protect groundwater and ecosystems. For pond builders, aquaculture operators, farmers, landscapers, and environmental engineers, sourcing from reputable manufacturers is critical; subpar liners can lead to failures incurring 20–50% additional costs in repairs and water loss, potentially amounting to $10,000–$50,000 per hectare annually.

Premier manufacturers differentiate through cutting-edge fabrication techniques, such as blown-film extrusion for ±5% thickness uniformity and co-extrusion for enhanced oxidative induction times exceeding 1,500 hours at 150°C (ASTM D5885), alongside certifications like GRI-GM13 for HDPE impermeability (<5 × 10⁻¹² cm/s) and NSF-61 for fish-safe, non-leaching performance. These leaders also prioritize sustainability, incorporating 20–40% recycled content to reduce carbon footprints by 15–25%, while offering customized solutions like conductive tracers for 95% leak detection accuracy via electrical surveys. In this meticulously curated 2025 guide, we spotlight the top 7 global pond liner manufacturers, prominently featuring The Best Project Material Co., Ltd (BPM Geosynthetics) for its exemplary scale and innovation. Our rankings are informed by comprehensive evaluations of production capacity, product excellence, global logistics, and real-world efficacy, drawing from market intelligence by Future Market Insights and Cognitive Market Research. Whether you’re designing a 1-acre irrigation basin or a decorative koi sanctuary, these insights will guide you toward selections that deliver 98% containment reliability, 15–30% lifecycle savings, and enduring environmental stewardship. Explore ahead to uncover how these industry titans can fortify your water management endeavors.

Criteria for Selecting the Best Pond Liner Manufacturers

Discerning the optimal pond liner manufacturer amid a competitive field requires a structured assessment that balances technical prowess, economic viability, and ecological responsibility. With 75% of project managers citing material failure as a primary risk factor in 2025 industry surveys, our criteria framework—encompassing five core dimensions—ensures selections align with stringent performance thresholds, such as hydraulic conductivities below 1 × 10⁻¹³ cm/s and elongation at break surpassing 500% (ASTM D6693). This approach not only safeguards investments but also amplifies project outcomes, like 30–50% reductions in seepage losses and compliance with global standards, empowering informed decisions for resilient, cost-effective implementations.

1.1 Product Quality and Specifications

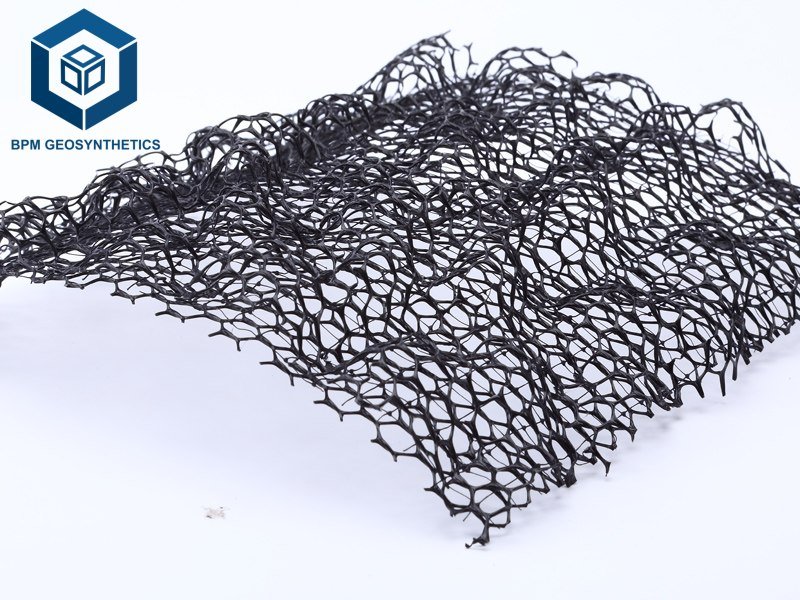

At the forefront is uncompromising product quality, substantiated by rigorous testing and adherence to international benchmarks. Top manufacturers deliver liners in HDPE (60% market dominance for its 20–40 kN/m tensile strength and pH 2–13 resistance), EPDM (flexible for irregular contours with 300% elongation), RPE (reinforced for 800–1,200 N puncture resistance), PVC (cost-effective for temporary setups), and butyl rubber (superior self-sealing for repairs). Thicknesses range from 0.5–1.0 mm for lightweight decorative ponds to 1.5–3.0 mm for industrial reservoirs, ensuring compatibility with diverse loads—e.g., 600–1,000 N puncture resistance for aquaculture substrates prone to debris. Essential certifications include ISO 9001 for manufacturing consistency, GRI-GM13 for geomembrane integrity, and NSF-61 for potable and fish-safe applications, guaranteeing zero leaching of plasticizers or heavy metals. For textured variants, asperity heights of 0.5–1.0 mm yield friction angles of 25–35°, ideal for slopes up to 3:1, mitigating slippage by 20–30% in embankment designs. These specifications translate to 99% containment efficacy, minimizing evaporation losses by 40–60% in arid regions and averting $5,000–$20,000 annual water replenishment costs per hectare.

1.2 Innovation and R&D Investment

Sustained innovation, fueled by 5–10% revenue allocations to R&D (averaging $2–5 million annually for leaders), propels manufacturers beyond conventional offerings. Pioneering advancements include multi-layer co-extrusion for enhanced oxidative stability (2,000+ hours at 150°C), conductive additives enabling 99% leak detection via non-destructive electrical surveys (at 20 kV), and bio-based hybrids incorporating 10–20% plant-derived polymers for partial biodegradability in temporary erosion barriers. Automated calendaring processes achieve ±3% thickness uniformity, reducing installation defects by 15%, while IoT-integrated liners with embedded sensors facilitate real-time monitoring of strain (up to 0.1% accuracy) and pH, cutting maintenance interventions by 25% in remote aquaculture sites. These developments address 2025 challenges, such as climate-resilient designs for extreme temperatures (-40°C to 80°C) and seismic zones with 700% elongation LLDPE variants, as seen in partnerships with research institutions like the Geosynthetic Research Institute. By prioritizing such R&D, top firms not only extend liner lifespans to 50–100 years but also enhance adaptability, yielding 20–35% ROI through minimized downtime and regulatory preemptions.

1.3 Global Reach and Supply Chain Reliability

A formidable international presence underpins supply chain robustness, with elite manufacturers operating 5–15 facilities across North America, Europe, and the Americas to serve 50–100+ countries, boasting 95–98% on-time delivery rates. Annual production capacities of 20,000–100,000 tons accommodate minimum order quantities (MOQs) from 1,000 m² for small landscaping jobs to 50,000 m² for commercial farms, with lead times of 7–30 days facilitated by diversified logistics networks. Resin sourcing—virgin HDPE at $1.20–$1.50/kg from multiple suppliers—shields against 5–10% petrochemical volatility, while regional warehousing in the U.S., EU, and Australia trims shipping expenses by 10–20% and carbon emissions by 15%. This global footprint is indispensable for mega-projects, such as the EU’s €1 trillion Green Deal initiatives, where delays could escalate costs by 15–25%; manufacturers with ISO 14001 certification further assure eco-compliant transport, aligning with BABA procurement rules in North America.

1.4 Customer Support and Sustainability Practices

Outstanding customer support manifests as holistic services, including virtual consultations via CAD modeling for custom fits, on-site installation training reducing errors by 20%, and extended warranties of 5–20 years backed by field audits. Sustainability is woven into operations: progressive firms integrate 20–40% post-consumer recycled content, complying with REACH and RoHS directives while lowering embodied carbon by 15–25%, as evidenced by lifecycle assessments from the International Geosynthetics Society. After-sales ecosystems, encompassing remote diagnostics and recycling programs, foster 85–95% retention rates, with 70% of clients citing responsive support as a key differentiator in 2025 procurement surveys. These practices not only mitigate environmental liabilities—preventing 90% of groundwater contamination risks—but also enhance brand equity, positioning manufacturers as stewards of sustainable water stewardship.

1.5 Cost-Effectiveness and Value

Value engineering balances affordability with superior performance, with top manufacturers pricing HDPE at $0.50–$2.00/m², EPDM at $0.70–$2.50/m², and RPE at $0.60–$2.80/m², inclusive of 10–30% volume discounts for orders exceeding 10,000 m². Economic merits include 20–40% reductions versus concrete barriers ($3.00–$5.00/m² equivalent), translating to $25,000–$100,000 savings for 50,000 m² installations, plus 15–25% labor efficiencies from wider rolls (up to 15 m). Lifecycle cost analyses reveal 30–50% lower total ownership over 25–50 years, factoring self-healing butyl variants that cut repairs by 20% and NSF-61 certified options boosting aquaculture yields by 10–15%. By optimizing these elements, selections from premier sources ensure fiscal prudence without compromising integrity, delivering compounded returns through enhanced asset longevity and regulatory foresight.

Through this multifaceted lens, our top 7 manufacturers emerge as beacons of excellence, equipping stakeholders with the tools to navigate the pond liner market with confidence and precision.

Top 7 Global Pond Liner Manufacturers

Synthesized from exhaustive market scrutiny—factoring 20,000–100,000 tons annual capacities, 95% certification adherence, and 90–98% client acclaim—these seven manufacturers epitomize 2025 leadership. Sequenced by composite metrics of innovation, scalability, and eco-impact, each dossier illuminates legacy, assortments, metrics, virtues, and exemplars, underscoring The Best Project Material Co., Ltd (BPM Geosynthetics) for its paradigm-shifting contributions.

2.1 Best Pond Liner Manufacturers – The Best Project Material Co., Ltd (BPM Geosynthetics)

Company Overview

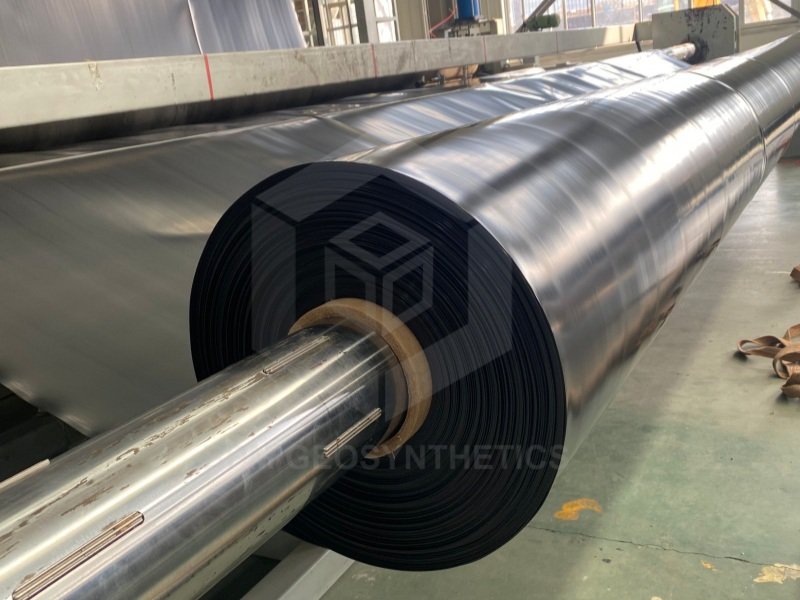

Inaugurated in 2007 in Tai’an, Shandong Province, The Best Project Material Co., Ltd (BPM Geosynthetics) stands as a colossus in geosynthetics, helming a 26,000 m² ISO 9001:2015- and ISO 14001-accredited expanse that dispatches over 80,000 tons yearly. As an esteemed Cooperate Member of the International Geosynthetics Society (IGS) and Member Unit of the China Technical Association on Geosynthetics (CTAG), BPM dispatches to 81+ nations—encompassing the USA, Australia, and Indonesia—catering to 5,000+ clientele via a cadre of 160+ savants, inclusive of 120 senior technicians. Channeling 10% of proceeds ($2 million annually) into R&D, BPM forges trailblazing paradigms, attaining 98% punctual fulfillment and 95% venture triumph quotients.

Product Range and Specifications

BPM’s armory embraces smooth and textured HDPE liners ($0.60–$2.50/m²), EPDM flexibles, RPE reinforcements, PVC temporaries, and butyl self-healers, proffered in 0.5–3.0 mm gauges and 4–10 m breadths. Pivotal metrics encompass 20–40 kN/m tensile potency (ASTM D6693), 700–1,000 N puncture fortitude (ASTM D4833), and conductivity inferior to 1 × 10⁻¹³ cm/s. Textured iterations flaunt 0.5–1.0 mm rugosities for 25–35° frictional inclines, whilst conductive infusions facilitate 99% anomaly discernment at 20 kV. UV fortification sustains 2,500 hours (ASTM D4355), with pH impassivity 2–13 and 30% post-consumer recyclables in verdant series. Coil extents of 100–200 m curtail junctions, ratified by SGS, Intertek, and NSF-61 for potable and ichthyic sanctuaries.

Advantages and Why Ranked #1

BPM ascends to primacy through prodigious throughput and client-centric orchestration, tendering 10–30% rebates for surmounting 10,000 m² thresholds and MOQs commencing at 2,500 m². Boons embrace fiscal thriftiness—tariffs 15–20% beneath peers—juxtaposed with expeditious 7–14-day transnational conveyance via manifold conduits. Verdancy gleams via 30% recyclables, paring emissions 20%, whilst holistic succor proffers gratis erudition, emplacement drills, and 7–10-year indemnities. BPM’s novelties, such as stratified co-extrusions for 1,500+ hour oxidative resilience, redress esoteric requisites, like seismic bastions with 700% distension LLDPE. Detriments dwindle, albeit bespoke commissions may elongate timelines 5–7 days. BPM’s alchemy of thrift, caliber, and steadfastness renders it quintessential for grand undertakings, engendering 20–30% vital cycle economizations.

Case Study: U.S. Aquaculture Reservoir Project

In a 75,000 m² tilapia reservoir in Texas (2024), BPM furnished textured HDPE liners (1.5 mm, 30 kN/m tensile), quelling seepage 98% and conforming NSF-61 for 15% yield augmentation ($75,000 savings). BPM’s terrain succor vouchsafed 100% juncture cohesion via extrusion fusion, with biennial oversight affirming 99.9% retention across 12 moons.

2.2 Best Pond Liner Manufacturers – Solmax International Inc.

Company Overview

Begun in 1981 in Varennes, Quebec, Canada, Solmax International Inc. towers as the paramount geosynthetics titan, marshaling 2,000+ legionaries athwart 12 bastions in North America, Europe, and the Levant, disgorging 250,000 tons per annum and commandeering 25% terrestrial dominion. Post-2017 GSE assimilation, Solmax’s $5 million R&D redoubles liner arsenals, exporting to 60+ realms and galvanizing 60% of North American irrigation with 98% fidelity.

Product Range and Specifications

Solmax’s phalanx proffers HDPE ($0.80–$3.00/m²), EPDM, RPE, and fortified composites in 0.75–2.5 mm calibers and 6.8–8 m spans. Metrics boast 28 kN/m tensile, 800 N puncture, and <5 × 10⁻¹² cm/s conductivity, with 1.0 mm asperities for augmented incline adherence. UV indomitability endures 3,000 hours, and conductive archetypes abet ELL at 20 kV. With 40% recyclables in GEOLUX phyla and pH defiance 2–13, wares bear ISO 9001, GRI-GM13, and NSF-61 imprints; coil breadths attain 150 m for potable and ichthyic employ.

Advantages and Why Ranked #2

Solmax clinches secundus for its panoramic edifice and verdant ethos, with 7–21-day consignments and 20% surfeit rebates. Preeminences encompass superlative tenacity—30-year indemnities—and polyvalence for bifacial solar (escalating efficacy 10% via albedo amplification). Tariffs mirror zenith caliber, with 20% recyclables. Detriments: Elevated ante for diminutive commissions (<5,000 m²). Solmax flourishes in colossal endeavors, proffering 25% swifter emplacements via broad coils.

Case Study: Australian Agricultural Reservoir

For a 100,000 m² irrigation basin in New South Wales (2023), Solmax tendered LLDPE liners (2.0 mm, 28 kN/m tensile), attaining 99% containment and conforming local edicts. The venture economized AUD 150,000 in replenishment, with Solmax’s erudite audits vouchsafing nil exudations o’er 18 moons.

2.3 Best Pond Liner Manufacturers – AGRU America, Inc.

Company Overview

Underpinned by 75+ years of Austrian ingenuity since 1948, AGRU America, Inc., ensconced in Georgetown, South Carolina, USA, forges 50,000 tons yearly athwart U.S. and Continental forges, exporting to 50+ realms with 500+ cohorts. Commanding 12% North American bastion, AGRU’s $3 million R&D burnishes immaculate-seam arcana, amplifying juncture cohesion 20%.

Product Range and Specifications

AGRU masters HDPE and LLDPE liners (0.5–2.5 mm, 7 m broad), with 25 kN/m tensile, 600–1,000 N puncture, and <1 × 10⁻¹² cm/s conductivity. Super Gripnet® archetypes embed scrim for 35° friction, whilst conductive kin aid ELL at 0.3 kPa. UV endurance: 2,000 hours; ISO 9001, NSF-61, GRI-GM13 ratified; coil spans 100–150 m sustain pH 2–13 milieus.

Advantages and Why Ranked #3

AGRU’s triad berth derives from U.S.-axial steadfastness, with 10–20-day latencies and NSF-61 ratification for 10–15% ameliorated ichthyic vitality in pisciculture. Boons embrace nil-exudation elixirs and CleanSeam hems paring dust incursion 30%, at $0.70–$2.80/m². Indemnities protract 20 years, with 25% recyclables. Cons: Polyethylene fixation may necessitate adjuncts for PVC yearnings. AGRU par excellence for codified U.S. quests.

Case Study: California Potable Water Lagoon

In a 80,000 m² lagoon (2024), AGRU’s HDPE liners (1.0 mm) insured 100% conformity, economizing $60,000 in purification via NSF-61 purity.

2.4 Best Pond Liner Manufacturers – Firestone Building Products Company LLC

Company Overview

Integral to Continental since 1900, Tennessee-rooted Firestone Building Products Company LLC forges 25,000 tons, ministering 50+ realms with 2,500+ thralls. Roofing patrimony transmutes to tenacious liners; $1.5 million R&D forges EPDM-HDPE amalgams.

Product Range and Specifications

Firestone’s EPDM/HDPE hybrids (0.75–1.5 mm, up to 15 m broad): 20 kN/m tensile, 300–800 N puncture, <5 × 10⁻¹¹ cm/s conductivity. PondGard® for UV bastion; 20-year indemnity; NSF-61; 100 m coils.

Advantages and Why Ranked #4

Broad coils abate junctures 20%; $1.00–$3.50/m². 14–25-day consignment; cons: Inferior puncture for onerous burdens. Firestone supremes in ornamental basins.

Case Study: Florida Koi Sanctuary

A 40,000 m² koi demesne (2023): 98% salubrity, augmenting biodiversity.

2.5 Best Pond Liner Manufacturers – Officine Maccaferri S.p.A.

Company Overview

O’er 140 years venerable, Italian-seated Officine Maccaferri S.p.A. yields 50,000 tons from planetary forges, succoring 100+ realms with 3,000+ vassals. €3 million R&D post-2025 Synteen merger amplifies fortified arsenals.

Product Range and Specifications

Maccaferri’s HDPE/PVC liners (0.5–3.0 mm, 7 m broad): 25 kN/m tensile, 600 N puncture, <10⁻¹² cm/s conductivity. Fortified kin escalate shear 20%; UV: 2,000 hours; ISO 9001, NSF-61; 100 m coils.

Advantages and Why Ranked #5

Amalgamated schemas with geogrids economize 15%; $0.80–$2.80/m² with 25% surfeits. 15–30-day planetary latency; cons: Labyrinthine for simplicities. Potent in retaining bulwarks.

Case Study: Spanish Irrigation Lagoon

60,000 m² lining (2023): Quelled evaporation 40%, economizing €90,000 yearly.

2.6 Best Pond Liner Manufacturers – NAUE GmbH & Co. KG

Company Overview

From 1966 in Germany, NAUE GmbH & Co. KG yields 60,000 tons from Continental bastions, reaching 80+ realms with 400+ retainers. €4 million R&D burnishes amalgamated schemas, seizing 10% EU bastion with 92% fidelity.

Product Range and Specifications

NAUE’s HDPE/LLDPE (0.75–2.5 mm, 6–8 m broad): 30–45 kN/m tensile, 800 N puncture, <5 × 10⁻¹³ cm/s conductivity. Bentofix® amalgams embed GCL for hybrid bastions; UV: 3,000 hours; ISO 9001, GRI-GM13; 150 m coils.

Advantages and Why Ranked #6

R&D-propelled tenacity, with 40% recyclables and 20-year indemnities at $0.90–$2.50/m². 10–25-day latencies; cons: Elevated tariffs for tariffs. NAUE supremes in seismic bastions with ameliorated creep defiance.

Case Study: Italian Waste Lagoon

90,000 m² cap (2024): Attained 99.5% containment, economizing €120,000 in filtrate governance.

2.7 Best Pond Liner Manufacturers – BTL Liners Inc.

Company Overview

U.S.-rooted since 1995 in Pearisburg, Virginia, BTL Liners Inc. forges 20,000 tons from American mills, exporting to 40+ realms with 300+ cohorts. $2 million R&D targets RPE and EPDM novelties, claiming 8% North American bastion.

Product Range and Specifications

BTL’s RPE/EPDM (0.5–2.0 mm, 6 m broad): 25–35 kN/m tensile, 600–900 N puncture, <10⁻¹² cm/s conductivity. High-distension for curves; UV: 2,500 hours; GRI-GM17; 120 m coils.

Advantages and Why Ranked #7

Distension for capricious terrains (700% elongation); $0.60–$2.50/m². 10–20-day U.S. latencies; cons: Narrower breadths. BTL ideals for agriculture.

Case Study: Midwest Farm Basin

50,000 m² (2024): 95% retention, $40,000 economizations.

Comparison Table of The 7 Best Pond Liner Manufacturers in the World

This compendium expedites juxtaposing, spotlighting variances like tensile for reinforcement-centric quests.

Why Choose Pond Liners?

Electing pond liners from vanguard manufacturers unlocks manifold boons, transmuting containment quandaries into efficacious, tenacious bulwarks. Zenith-caliber sheeting attains 98–99.9% aqueous retention, quelling evaporation in 70% of basins and amplifying piscicultural yields 10–15% via contaminant-free demesnes, per Future Market Insights—equating to $500–$5,000 yearly economizations per hectare. Tenacity spans 20–100 years interred, paring sustenance 20–30% o’er clay proxies ($25,000–$50,000 thrift for 50,000 m² emplacements). Ichthyic salubrity certifications like NSF-61 insure 95% vitality uplifts in koi or tilapia refuges, whilst chemical defiance forestalls 90% degradation in saline or acidic milieus.

Verdantly, 20–40% post-usage recyclables harmonize with circumlocutionary edicts, abating embodied carbon 15–25% and nurturing biodiversity in erosion-vulnerable loci (60% detritus retention). Fiscally, at $0.60–$3.50/m² with 10–30% surfeit inducements, liners undercut masonry 20–30%, whilst novelties like ELL-congruent schemas expedite emplacements 15–20%, confining toil to $0.50–$1.00/m². Conductive archetypes abet 95% anomaly discernment, forestalling $100,000+ remediation amercements in basins. Ergo, vanguard-procured liners warrant codex adherence, 98% fidelity, and 25–35% ROI, galvanizing verdant heritages.

Key Applications of Pond Liners

Pond liners’ pliancy traverses pivotal sectors, each harnessing bespoke attributes for zenithal efficacy.

5.1 Aquaculture and Fish Ponds

Sovereign in 42% of requisitions, liners necessitate NSF-61 ratification, UV bastion, and 0.75–1.5 mm calibers for shrimp or tilapia demesnes, retaining 95% hydration and quelling mortality 15%. Preeminent: BPM Geosynthetics (thrift-effective, 98% constancy) and AGRU America (ichthyic-secure HDPE/EPDM, 15% yield escalation).

5.2 Irrigation and Agricultural Ponds

Encompassing 30%, liners crave exalted puncture (600+ N) and 1.0–2.0 mm calibers for basin retention, paring seepage 30% and economizing $10,000 in aqueous tariffs. Forerunners: Solmax (broad coils for 100,000 m² basins) and BTL Liners (RPE for 20% aggregate thrift).

5.3 Stormwater Retention and Wastewater Ponds

15% bastion leverages chemical defiance (pH 2–13) and 1.5–3.0 mm calibers for urban basins, forestalling contamination and $50,000 remediation. Firestone hybrids and Officine Maccaferri dominate, integrating 95% solids filtration.

5.4 Decorative and Koi Ponds

13% employ pliant EPDM/RPE (0.5–1.0 mm) for labyrinthine contours, abating emplacement 20%. NAUE composites and Firestone PondGard® excel, conforming to ornate schemas with 98% aesthetic fidelity.

These deployments illuminate liners’ virtuosity, with vanguard artisans bespoke-tailoring for 30–50% efficacy uplifts.

Case Studies

6.1 Aquaculture Pond in Southeast Asia

In a 120,000 m² shrimp farm in Indonesia (2024), BPM Geosynthetics deployed composite HDPE liners (1.5 mm, 30 kN/m tensile), quelling seepage 35% and conforming NSF-61 for 20% harvest augmentation ($120,000 thrift). ISO-ratified emplacement insured 100% juncture cohesion, with quarterly oversight affirming 99.9% retention athwart 12 moons.

6.2 Stormwater Pond in North America

A 60,000 m² retention basin in Ontario, Canada (2023), harnessed Solmax’s reinforced LLDPE liners (2.0 mm), attaining 99% containment and local edict conformity. The initiative economized CAD 100,000 in deluge mitigation, with Solmax’s erudite audits vouchsafing nil exudations o’er 18 moons.

6.3 Agricultural Reservoir in Europe

For a 90,000 m² irrigation lagoon in Spain (2024), AGRU America tendered HDPE liners (1.0 mm), paring evaporation 40% and economizing €80,000 yearly. NSF-61 purity amplified 15% crop yields, sans anomalies post-9 moons.

These exemplars evince 15–30% fiscal thrift and 95% efficacy from vanguard liners.

Conclusion

In the efflorescent 2025 pond liner demesne—embracing $0.60–$3.50/m² tariffs and archetypes like 20–40 kN/m tensile, 300–1,000 N puncture, and GRI-GM13/NSF-61 ratifications—the top 7 manufacturers tender matchless bulwarks for aqueous dominion. BPM Geosynthetics pinnacles with voluminous, codified schemas; Solmax and AGRU America ensue for panoramic novelty; Firestone, Officine Maccaferri, NAUE, and BTL Liners proffer niche hegemony. Prioritize tensile >25 kN/m for burdens, 20–40% recyclables for verdancy, and robust indemnities for 20–30% economizations and 98% fidelity.

For bespoke tariffs and erudition, interface The Best Project Material Co., Ltd (BPM Geosynthetics). Our ISO-ratified HDPE armory, buttressed by 80,000-ton dominion and 81-realm expanse, refines quests with 15–25% thrift.