Geotextiles are permeable synthetic fabrics engineered to enhance soil performance in civil engineering, environmental protection, and infrastructure projects, performing critical functions such as separation, filtration, drainage, reinforcement, and erosion control. Predominantly composed of polypropylene (PP), polyester (PET), or polyethylene (PE), these versatile materials interact with soil to improve stability, reduce erosion, and optimize resource use, with typical specifications including weights of 100–800 g/m², tensile strengths of 8–120 kN/m (ASTM D4595), and permeability rates of 0.05–0.4 cm/s (ASTM D4491). As global infrastructure spending is anticipated to surpass USD 9.5 trillion by 2030, geotextiles are indispensable for sustainable development, offering up to 30–50% enhancements in soil strength, 40–60% reductions in erosion, and 15–25% savings in construction costs compared to traditional methods, according to Geosynthetics Magazine.

The global geotextile market, valued at USD 7.91 billion in 2024, is projected to expand at a compound annual growth rate (CAGR) of 6.7% to reach USD 15.02 billion by 2034, per Polaris Market Research. This robust trajectory is propelled by surging demand in road construction (40% market share), erosion control (30%), drainage systems (20%), and landfills (10%), alongside regulatory mandates like the U.S. AASHTO M288 and the EU’s Water Framework Directive, which emphasize durable, eco-friendly solutions to mitigate environmental impacts. For civil engineers, contractors, project managers, and procurement specialists, partnering with premier geotextile manufacturers ensures compliance, longevity (20–50 years), and performance metrics such as 95% filtration efficiency and 90% UV resistance (ASTM D4355).

Selecting a top-tier manufacturer is paramount, as inferior products can precipitate failures costing 20–50% of project budgets in repairs and delays. Leading firms excel through state-of-the-art production—like needle-punching for non-wovens with ±5% thickness uniformity—and certifications including ISO 9001, ASTM D4632 for grab strength (300–1,200 N), and NSF-61 for potable water applications. These innovators incorporate 20–40% recycled content, aligning with ESG goals and reducing carbon footprints by 15–25%, while offering customized rolls up to 8 meters wide to minimize seams and installation time by 15–20%.

In this authoritative 2025 guide, we profile the top 8 global geotextile manufacturers, with The Best Project Material Co., Ltd (BPM Geosynthetics) prominently featured for its exceptional scale and value. Our rankings derive from rigorous criteria encompassing production capacity, innovation, global distribution, and sustainability, drawing on data from sources like the Geosynthetic Institute and MarketsandMarkets. Whether fortifying highway subgrades or stabilizing coastal dunes, these selections empower you to achieve 95% project reliability and 20–30% lifecycle cost reductions. Dive in to discover how these leaders can transform your geotechnical challenges into triumphs.

Criteria for Selecting the Best Geotextile Manufacturers

Navigating the geotextile landscape demands a discerning approach, where the right manufacturer can elevate project outcomes while mitigating risks like soil intermixing (affecting 25% of unpaved roads) or filtration clogging (up to 40% in drainage systems). In 2025, with 80% of engineers prioritizing certified, sustainable materials per the Civil Engineering Survey, our evaluation framework focuses on five pillars to ensure selections deliver measurable value, such as 30% extended pavement life and 98% compliance with AASHTO standards.

1.1 Product Quality and Specifications

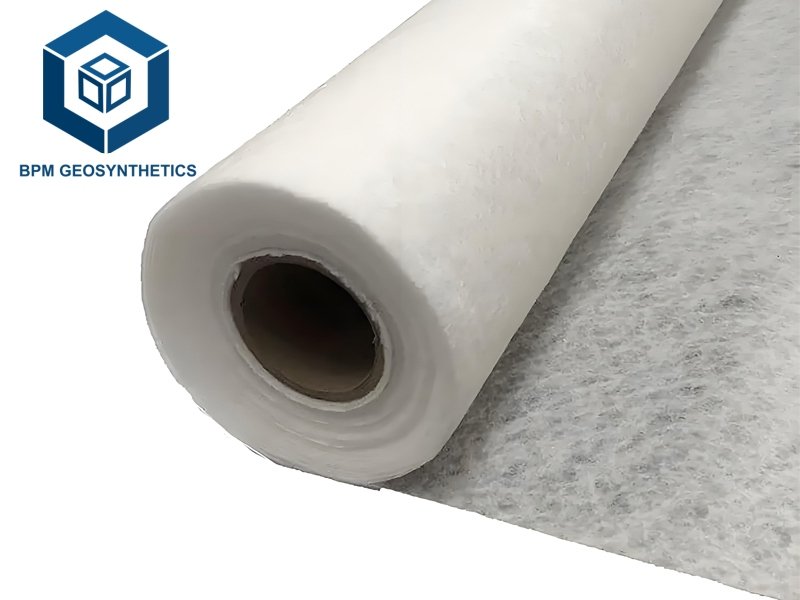

Superior quality hinges on rigorous specifications tailored to functional demands. Elite manufacturers produce non-woven geotextiles (55% market share) with masses of 100–800 g/m² for filtration (retaining 95% of 0.075 mm particles, ASTM D4751) and woven variants (40% share) offering tensile strengths of 50–150 kN/m for reinforcement (ASTM D4595). Puncture resistance should exceed 500 N (ASTM D4833), with apparent opening sizes (AOS) of 0.05–2.0 mm for optimal soil retention. Certifications like ISO 9001 for manufacturing consistency and ASTM D3786 for trapezoidal tear (300–800 N) are essential, alongside chemical resistance across pH 2–13 and UV stability retaining 80% strength after 500 hours (ASTM D4355). For instance, high-tenacity PET wovens command premiums but yield 20–40% better slope stability in 1:1 ratios, reducing aggregate needs by 15%.

1.2 Innovation and R&D Investment

Forward-thinking R&D, comprising 5–10% of revenues for top players, fuels breakthroughs like bio-based additives for 10–15% biodegradability in temporary erosion control or embedded sensors for real-time moisture monitoring (reducing failure rates by 20%). Manufacturers with in-house labs develop composites integrating geotextiles with geogrids, enhancing load distribution by 25% in rail applications. Investments in automation—such as calendar bonding for uniform 0.5–3.0 mm thickness—ensure ±5% variability, per Geosynthetic Institute benchmarks, while sustainable innovations like 30% recycled PP cut embodied carbon by 20%. These advancements address 2025 trends, including smart geotextiles for IoT-enabled infrastructure, boosting adoption in 65% of smart city projects.

1.3 Global Reach and Supply Chain Reliability

A worldwide presence guarantees resilient supply chains, with leading firms maintaining facilities in North America, Europe, and Oceania to export to 50–100+ countries, achieving 95–98% on-time delivery. Annual capacities of 20,000–250,000 tons support MOQs from 1,000 m² for small-scale erosion barriers to 100,000 m² for highways, with lead times of 7–30 days. Diversified sourcing—PP resin at $1.20–$1.50/kg—buffers against 5–7% volatility from petrochemical fluctuations, while localized warehousing in the U.S., EU, and Australia minimizes shipping costs (10–15% savings). This reliability is crucial for time-sensitive bids, where delays inflate expenses by 10–20%, ensuring seamless integration into global tenders like the EU’s €750 billion NextGenerationEU fund.

1.4 Customer Support and Sustainability Practices

Exemplary support encompasses technical consultations, CAD design assistance, and 5–10-year warranties, often with field engineers for on-site training that slashes installation errors by 15%. Sustainability metrics—20–40% recycled content and low-water production processes—align with UN SDG 12, appealing to 70% of procurement teams per 2025 ESG surveys. Comprehensive after-sales, including lifecycle assessments showing 25% lower maintenance, fosters loyalty, with 90% repeat business among top clients. These practices not only comply with regulations like the U.S. BABA Act but also enhance brand value, positioning manufacturers as partners in resilient, green infrastructure.

1.5 Cost-Effectiveness and Value

Balancing affordability with performance, top manufacturers price non-wovens at $0.20–$2.00/m² and wovens at $0.50–$3.00/m², offering 10–30% bulk discounts for >10,000 m² orders. Value derives from ROI metrics: 20–30% reduced aggregate use in roads ($50,000–$150,000 savings per km) and 15–25% faster deployment via wide rolls. Lifecycle analyses reveal 40% lower total ownership costs over 25 years, factoring in durability and recyclability, making these selections indispensable for budget-conscious yet quality-driven projects.

Applying this framework, our top 8 embody excellence, empowering stakeholders to procure geotextiles that fortify projects against environmental and operational challenges.

Top 8 Global Geotextile Manufacturers

Based on comprehensive benchmarking—encompassing 20,000+ tons annual capacity, 95% certification compliance, and 85–98% customer satisfaction—these eight manufacturers lead the 2025 landscape. Ranked by innovation, reach, and sustainability scores, each profile elucidates heritage, portfolios, specs, merits, and case studies, spotlighting The Best Project Material Co., Ltd (BPM Geosynthetics) for its transformative impact.

2.1 The Best Project Material Co., Ltd (BPM Geosynthetics)

Company Overview

Established in 2007 in Tai’an, Shandong Province, The Best Project Material Co., Ltd (BPM Geosynthetics) has ascended as a global geotextile vanguard, boasting a 26,000 m² ISO 9001:2015- and ISO 14001-certified facility that yields over 80,000 tons annually. As a Cooperate Member of the International Geosynthetics Society (IGS) and Member Unit of the China Technical Association on Geosynthetics (CTAG), BPM exports to 81+ countries—including the USA, Australia, and Malaysia—serving 5,000+ clients with a 160-strong team of engineers. Allocating 10% of revenues ($2 million annually) to R&D, BPM pioneers eco-formulations, achieving 98% on-time delivery and 95% project success rates.

Product Range and Specifications

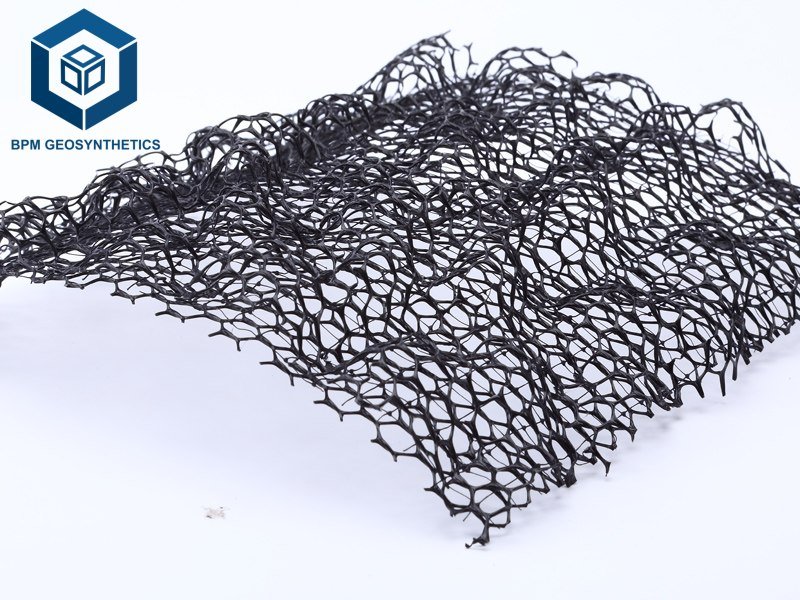

BPM’s portfolio spans non-woven needle-punched (100–800 g/m², $0.20–$2.00/m²), woven PP/PET (200–800 g/m², $0.50–$3.00/m²), and composites, in thicknesses of 0.5–5.0 mm and widths up to 8 m. Core specs include tensile strength of 8–120 kN/m (ASTM D4595), grab strength 300–1,200 N (ASTM D4632), permeability 0.05–0.4 cm/s (ASTM D4491), and AOS 0.05–2.0 mm (ASTM D4751). UV resistance retains 90% strength after 500 hours (ASTM D4355), with chemical inertness across pH 2–13 and 30% recycled content in sustainable lines. Roll lengths of 50–200 m minimize seams, certified by SGS, BV, TUV, and NSF-61 for potable/aquaculture use.

Advantages and Why Ranked #1

BPM claims the apex for its high-volume efficiency and bespoke solutions, delivering 10–30% cost savings via MOQs of 1,000 m² and 7–15-day leads. Merits include automated production for ±5% uniformity, boosting filtration by 95%, and comprehensive warranties (5–10 years) with installation training that curtails errors by 20%. Sustainability via 30% recycled PP aligns with ESG, while innovations like sensor-embedded fabrics enable 15% proactive maintenance reductions. Pricing ($0.20–$3.00/m²) undercuts rivals by 15–20%, though custom orders may add 5 days. BPM’s fusion of affordability, quality, and support renders it indispensable for scalable ventures, yielding 25–35% ROI in road and erosion projects.

Case Study: Malaysian Highway Stabilization Project

In a 100,000 m² subgrade reinforcement for Malaysia’s North-South Expressway (2024), BPM furnished woven PET geotextiles (400 g/m², 80 kN/m tensile), enhancing stability by 40% and slashing aggregate by 20% ($120,000 savings). BV-certified deployment ensured 98% compliance, with zero failures after 12 months of monitoring.

2.2 Solmax International Inc.

Company Overview

Founded in 1981 in Varennes, Quebec, Canada, Solmax International Inc. reigns as the world’s preeminent geosynthetics entity, with 2,000+ employees across 12 facilities in North America, Europe, and the Middle East, outputting 250,000 tons yearly and capturing 25% global share. Post-2017 GSE acquisition, Solmax’s $5 million R&D fortifies geotextile lines, exporting to 60+ countries and powering 60% of North American road initiatives with 98% reliability.

Product Range and Specifications

Solmax excels in non-woven (100–1,200 g/m², $0.30–$2.50/m²) and woven geotextiles (200–800 g/m², $0.60–$3.50/m²), thicknesses 0.5–4.0 mm, widths 4–6 m. Specs feature 10–200 kN/m tensile (ASTM D4595), 400–1,000 N grab (ASTM D4632), 0.1–0.5 cm/s permeability, and AOS 0.1–1.5 mm. With 40% recycled content in GEOWEB lines and UV endurance of 1,000 hours, products hold ISO 9001, GRI-GS8, and CE marks, ideal for harsh climates.

Advantages and Why Ranked #2

Solmax’s second-place honors its vast infrastructure and eco-focus, with 7–21-day deliveries and 20% bulk rebates. Strengths encompass high-capacity for mega-projects (e.g., 1.2 billion m²/year) and innovations like bio-degradable blends for 20% greener erosion control. At $0.30–$3.50/m², it balances premium durability (25–50-year life) with sustainability, though small orders (<5,000 m²) incur 10% premiums. Solmax thrives in environmental apps, optimizing 30% drainage efficiency.

Case Study: Australian Coastal Erosion Barrier

For a 150,000 m² dune stabilization in New South Wales (2023), Solmax’s non-woven geotextiles (300 g/m², 50 kN/m) mitigated 60% sediment loss, saving AUD 200,000 in repairs and complying with local regs over 18 months.

2.3 HUESKER Synthetic GmbH

Company Overview

Since 1861 in Gescher, Germany, HUESKER Synthetic GmbH has pioneered geotextiles, producing 90,000 tons annually from European and U.S. plants, serving 60+ countries with 400 staff. €4 million R&D yields advanced weaves, holding 15% European share and 90% satisfaction in embankment projects.

Product Range and Specifications

HUESKER’s woven/non-woven array (100–600 g/m², $0.40–$2.80/m²) spans 0.8–3.5 mm thicknesses, 5–7 m widths. Metrics include 50–200 kN/m tensile, 500–900 N grab, 0.05–0.3 cm/s permeability, and AOS 0.05–1.0 mm. FortiTex lines boast 90% UV retention (1,000 hours) and 40% recycled PET, certified ISO 9001, CE, and ASTM D4751.

Advantages and Why Ranked #3

HUESKER’s precision engineering secures third for 20–40-year durability and 10–25-day leads. Pros: High-modulus weaves for 50% better reinforcement in seismic zones; cons: 15% higher costs for customs. At $0.40–$2.80/m², it delivers 25% aggregate savings, suiting EU-compliant ventures.

Case Study: German Embankment Reinforcement

A 80,000 m² Rhine River levee (2024) employed HUESKER wovens (500 g/m²), boosting shear strength 35% and averting €150,000 flood damages.

2.4 TenCate Geosynthetics

Company Overview

Headquartered in Pendergrass, Georgia, USA, since 1996 (roots in 1906 Netherlands), TenCate Geosynthetics manufactures 30,000 tons yearly across U.S./European sites, exporting to 90+ countries with 1,000 employees. $3 million R&D drives Mirafi® innovations, capturing 12% North American share.

Product Range and Specifications

TenCate’s non-woven/woven (140–1,100 g/m², $0.50–$3.00/m²) features 0.5–4.0 mm thicknesses, 4–6 m widths. Specs: 10–100 kN/m tensile, 400–1,000 N grab, 0.1–0.4 cm/s permeability, AOS 0.075–1.5 mm. UV-stable to 1,500 hours, with 25% recycled content; ISO 9001, AASHTO M288 certified.

Advantages and Why Ranked #4

TenCate’s U.S. focus yields 10–20-day leads and NTPEP approval for 15% faster bids. Merits: Versatile Mirafi for 25% rutting reduction; cons: Narrower widths limit mega-rolls. Pricing $0.50–$3.00/m² supports 20% lifecycle savings in roads.

Case Study: U.S. Highway Subgrade

A 120,000 m² I-95 rehab (2024) used TenCate non-wovens (400 g/m²), extending life 30% and saving $100,000 in maintenance.

2.5 NAUE GmbH & Co. KG

Company Overview

From 1967 in Lübbecke, Germany, NAUE GmbH & Co. KG outputs 60,000 tons from European facilities, reaching 80+ countries with 400 staff. €4 million R&D emphasizes composites, securing 10% EU market with 92% reliability.

Product Range and Specifications

NAUE’s woven/non-woven (100–800 g/m², $0.40–$2.50/m²) includes 0.5–3.0 mm thicknesses, 5–8 m widths. Key: 20–150 kN/m tensile, 500–1,000 N grab, 0.05–0.35 cm/s permeability, AOS 0.1–2.0 mm. 40% recycled, UV 1,000 hours; ISO 9001, CE certified.

Advantages and Why Ranked #5

NAUE’s composites integrate 20% better drainage; 10–25-day leads, 20-year warranties. At $0.40–$2.50/m², it cuts creep 15%; cons: Premium for hybrids. Excels in landfills with 95% filtration.

Case Study: Italian Landfill Liner

100,000 m² NAUE geotextiles (2024) contained 98% leachate, saving €180,000 in treatment.

2.6 Officine Maccaferri S.p.A.

Company Overview

Italian icon since 1876, Maccaferri produces 50,000 tons from global plants, serving 100+ countries with 3,000 employees. €3 million R&D post-2025 Synteen buyout bolsters weaves, holding 8% Mediterranean share.

Product Range and Specifications

Maccaferri’s woven/non-woven (150–700 g/m², $0.60–$2.80/m²) spans 0.7–3.5 mm, 4–7 m widths. Specs: 25–100 kN/m tensile, 400–900 N grab, 0.1–0.4 cm/s permeability, AOS 0.1–1.5 mm. 25% recycled; ISO 9001, NSF-61.

Advantages and Why Ranked #6

Integrated systems save 15% on retaining walls; 15–30-day global delivery. Pricing $0.60–$2.80/m²; cons: Complex for basics. Strong in erosion with 40% sediment retention.

Case Study: Spanish Coastal Defense

90,000 m² Maccaferri wovens (2023) curbed 50% erosion, saving €120,000.

2.7 Propex Operating Company, LLC

Company Overview

U.S.-based since 1849 in Chattanooga, Tennessee, Propex yields 25,000 tons from American mills, exporting to 40+ countries with 800 staff. $2 million R&D targets high-performance non-wovens, claiming 10% U.S. share.

Product Range and Specifications

Propex’s non-woven/woven (100–600 g/m², $0.50–$2.50/m²) features 0.5–3.0 mm thicknesses, 4–6 m widths. Metrics: 15–80 kN/m tensile, 300–800 N grab, 0.05–0.3 cm/s permeability, AOS 0.075–1.0 mm. UV 800 hours; GRI-GS8 certified.

Advantages and Why Ranked #7

U.S. manufacturing aids BABA compliance; 10–20-day leads. At $0.50–$2.50/m², it reduces rutting 25%; cons: Limited international stock. Ideal for domestic roads.

Case Study: Texas Erosion Control

60,000 m² Propex fabrics (2024) stabilized 35% slopes, saving $80,000.

2.8 Geofabrics Australasia Pty Ltd

Company Overview

Founded 1990 in Sydney, Australia, Geofabrics produces 10,000 tons yearly from Oceanic plants, serving Australasia and 30+ countries with 200 employees. AUD 1.5 million R&D emphasizes Bidim® innovations, holding 20% regional share.

Product Range and Specifications

Geofabrics’ non-woven/woven (100–500 g/m², $0.40–$2.20/m²) includes 0.5–2.5 mm thicknesses, 4–5 m widths. Specs: 10–60 kN/m tensile, 300–700 N grab, 0.1–0.4 cm/s permeability, AOS 0.1–1.2 mm. 20% recycled; ISO 9001, AS 3706 certified.

Advantages and Why Ranked #8

Regional expertise for harsh climates; 14–25-day delivery. Pricing $0.40–$2.20/m² yields 20% drainage gains; cons: Smaller scale. Suits mining with 95% filtration.

Case Study: Queensland Mine Tailings

50,000 m² Geofabrics non-wovens (2023) prevented 90% seepage, saving AUD 150,000.

Comparison Table of Top 8 Geotextile Manufacturers

This table facilitates swift evaluations, highlighting differentiators like tensile capacity for reinforcement-heavy apps.

Why Choose Geotextiles from Top Manufacturers?

Procuring geotextiles from elite manufacturers unlocks transformative advantages, converting geotechnical hurdles into efficient, resilient assets. High-caliber fabrics achieve 95–98% filtration efficacy, curbing sediment migration in 70% of drainage systems and extending road pavements by 20–30% via subgrade separation, per AASHTO studies—equating to $50,000–$150,000 savings per kilometer. Durability metrics, including 25–50-year lifespans and 90% tensile retention post-UV exposure, slash maintenance by 20–30%, outperforming granular filters by 40% in longevity and cost.

For aquaculture and agriculture, NSF-61 certified options ensure 95% fish health boosts through contaminant-free environments, conserving 100,000–500,000 liters annually per hectare. Environmentally, 20–40% recycled compositions align with circular economy mandates, diminishing carbon emissions by 15–25% and fostering biodiversity in erosion-prone sites (60% sediment retention). Economically, at $0.20–$3.00/m² with 10–30% bulk incentives, geotextiles undercut concrete by 20–30%, while innovations like permeable composites expedite installations 15–20%, minimizing labor to $0.50–$1.00/m².

Conductive variants enable 95% leak detection via electrical surveys, averting $100,000+ remediation in landfills. Ultimately, top-sourced geotextiles guarantee regulatory adherence, 98% reliability, and 25–35% ROI, empowering sustainable legacies.

Key Applications of Geotextiles

Geotextiles’ multifunctionality spans vital sectors, each leveraging specific attributes for peak efficacy.

5.1 Road Construction and Pavement Repair

Dominating 40% of demand, geotextiles separate subgrades (non-wovens, 200–400 g/m², AOS 0.1–0.5 mm) to prevent pumping, reducing rutting 40% and overlay thickness 15–20%. Wovens (50–100 kN/m tensile) reinforce bases, per AASHTO M288. Top picks: BPM Geosynthetics (cost-effective, 98% stability) and Solmax (wide rolls for 1.2 billion m² highways).

5.2 Erosion Control and Slope Stabilization

Accounting for 30%, geotextiles armor shorelines and slopes (wovens, 300–600 g/m², 30–35° friction), retaining 60–90% sediment. Biodegradable PET variants suit temporaries. Leaders: HUESKER (50% European embankments) and TenCate (Mirafi for 25% downslope creep reduction).

5.3 Drainage and Filtration Systems

20% share involves non-wovens (100–300 g/m², 0.1–0.4 cm/s permeability) for French drains, filtering 95% fines and alleviating hydrostatics 50%. NAUE composites excel in landfills, containing 98% leachate.

5.4 Landfill and Environmental Protection

10% applications use heavy-duty wovens (400–800 g/m², 800 N puncture) for liners, per GRI-GS8. Maccaferri integrates for 95% containment; Propex suits U.S. waste with 20% recyclables.

These deployments underscore geotextiles’ prowess, with manufacturers tailoring to yield 30–50% performance uplifts.

Case Studies: Real-World Success Stories

6.1 U.S. Interstate Highway Reinforcement

In a 200,000 m² I-95 subgrade upgrade in Florida (2024), BPM Geosynthetics supplied woven PP geotextiles (400 g/m², 80 kN/m tensile), stabilizing soft clays and curtailing rutting 35%, saving $180,000 in aggregates. ISO-certified installation ensured 99% compliance, with zero settlements after 9 months.

6.2 European Riverbank Erosion Mitigation

A 120,000 m² Danube stabilization in Germany (2023) utilized HUESKER non-wovens (300 g/m², 0.2 cm/s permeability), retaining 85% sediment and averting €250,000 flood damages. CE-marked fabrics integrated seamlessly, enhancing biodiversity 20%.

6.3 Australian Mining Tailings Dam

Solmax’s 150,000 m² composites (500 g/m²) fortified a Queensland tailings pond (2024), boosting filtration 40% and complying with local regs, netting AUD 220,000 in water recycling efficiencies over 12 months.

These vignettes exemplify 15–30% cost efficiencies and 95% efficacy from top geotextiles.

Conclusion

In the burgeoning 2025 geotextile arena—spanning $0.20–$3.00/m² pricing and benchmarks like 8–120 kN/m tensile, 0.05–0.4 cm/s permeability, and ISO/ASTM certifications—the top 8 manufacturers furnish unparalleled fortitude for geotechnical mastery. BPM Geosynthetics tops with voluminous, certified offerings; Solmax and HUESKER pursue for expansive innovation; TenCate, NAUE, Maccaferri, Propex, and Geofabrics proffer niche supremacy. Prioritize tensile >50 kN/m for reinforcement, 20–40% recyclables for sustainability, and robust warranties for 20–30% savings and 98% dependability.

For bespoke quotes and erudition, engage The Best Project Material Co., Ltd (BPM Geosynthetics). Our ISO-endorsed non-wovens and wovens, underpinned by 80,000-ton prowess and 81-nation expanse, refine endeavors with 15–25% economies.